MANILA, Philippines— Fund investing has become more accessible and hassle-free, thanks to a new partnership between Investa, the country’s leading Social Financial Platform, and Maya, the #1 Digital Banking App in the Philippines.

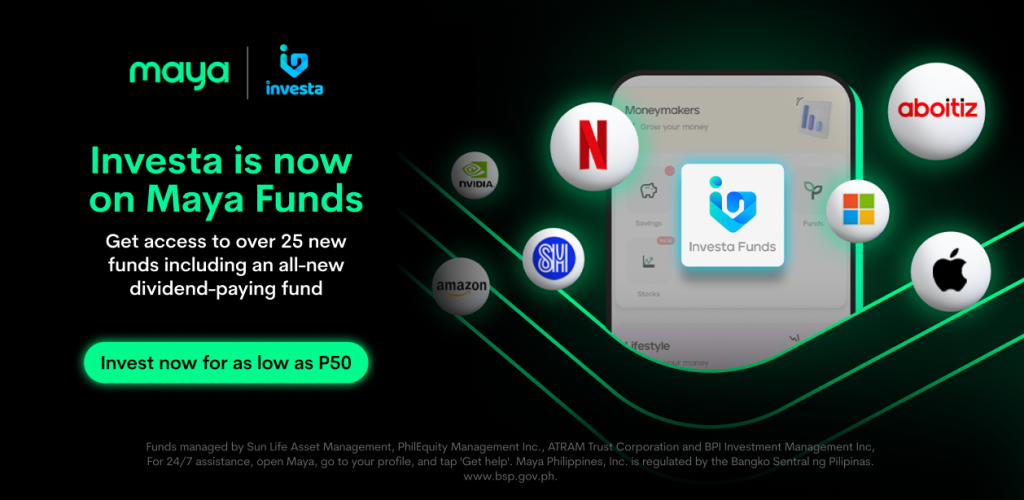

Investa has now launched as the second provider in Maya Funds to bring a fresh addition to the platform. This will give Filipinos access to a wide range of twenty-seven mutual funds from industry leaders including ATRAM, BPI Investment Management Inc., Sunlife, and Philequity.

Through this partnership, Investa will be able to offer micro-investment through the Maya Funds feature on the app. Filipinos can now choose to invest in credible and well-trusted local and global funds. Investa’s pursuit of making investing more accessible is boosted by this integration as Maya users can now invest, borrow, spend and save in a single platform.

“We’re excited to enhance Maya Funds with the addition of Investa as one of our partner providers. This latest addition underscores our commitment to empowering Filipinos to invest smarter and more effectively, helping them achieve their financial goals,” said Shailesh Baidwan, Maya Group President and Co-founder of Maya Bank.

This collaboration alleviates the problems Filipinos face with investing by providing a seamless and accessible solution to get an opportunity to take part in the financial markets.

“We are thrilled to work with Maya to bring our innovative investment solutions to a wider audience,” said Airwyn Tin, Co-founder and CEO of Investa. “Together, we are committed to empowering Filipinos to build wealth and achieve financial freedom through smart and sustainable investing.”

Key features include:

- Real-time account opening. Users can use their existing Investa account or open one directly through the Maya app to make the onboarding process quick and easy.

- Real-time transfers. Invest swiftly with instant cash-in and cash-out features from the Maya wallet to the Investa account.

- Low investment threshold. Users can start for as low as P50 and invest in mutual funds to make it accessible to more Filipinos.

- Diverse investment options. Choose from 27 funds under well-known and professional asset management companies as an instant way to diversify your portfolio depending on your risk profile.

- Cash dividends. If the customer opts to invest in dividend-paying funds, they can receive these cash dividends directly to their Investa accounts. From there, they can easily transfer it to their Maya wallet as well.

Investa and Maya Funds joining forces is their way of taking a solid step towards opening the public towards micro-investments with a seamless integration that allows Filipinos to actively control their financial future with confidence.

About Maya:

Maya is the #1 Fintech Ecosystem in the Philippines, with Maya, the #1 Digital Bank, and Maya Business, the #1 Omni-Channel Payment Processor. Maya Bank is a digital bank regulated by the Bangko Sentral ng Pilipinas (BSP), with deposits insured by the Philippine Deposit Insurance Corporation (PDIC) up to ₱500,000 per depositor. To learn more about Maya, check out maya.ph and mayabank.ph.

About Investa:

Investa’s mission is to enable Filipinos in their investing journey with the right tools, education, and technology. Investa is an online mutual fund distribution platform owned and operated by InvestaFinancial Inc – a corporation duly organized and existing under Philippines Law and is regulated and licensed by the Securities and Exchange Commission as a mutual fund distributor. To learn more, you can visit investa.ph.