@style23 takes the spotlight for this week’s featured trader as he shared his simple, but effective trade on $BTC!

As Leonardo Da Vinci says, “simplicity is the ultimate sophistication.” In trading, you don’t need the most complex tools, strategies, or equipment. All you need is a good understanding of the market’s behavior and the effort to plan out how you can navigate through the volatility.

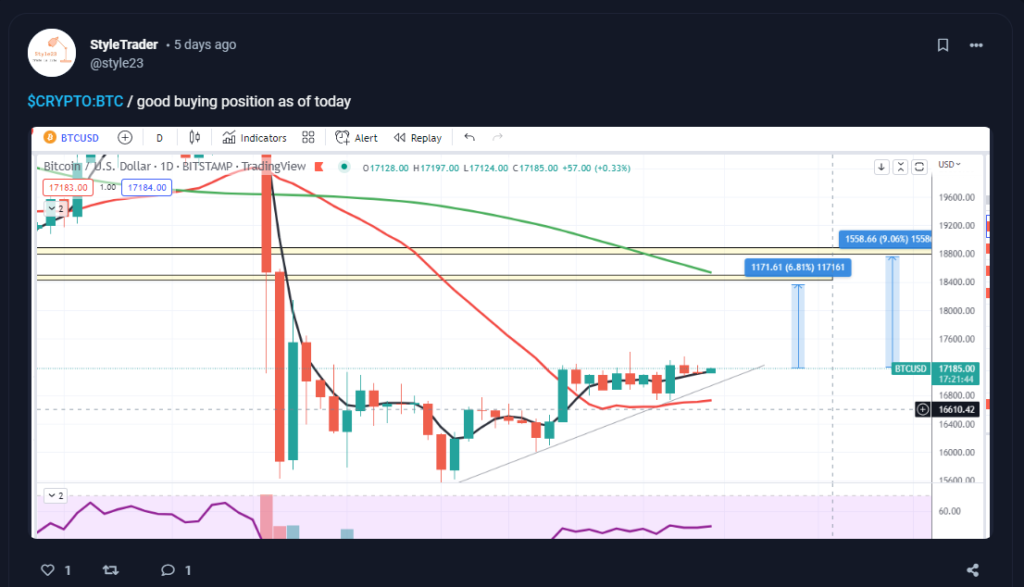

@style23 shared his swing trade idea on $BTC and where it might head using just a few charting tools.

Based on the analysis, it can be seen that prices were sitting on a confluence of supports. Whenever trendlines and moving averages go hand in hand, the support tends to be stronger. Resistances were also easy to spot since the longer-term moving average was also in confluence with the 18,400 price level. As volatility compressed, easy entries and exits could be found. For the entry, you can either buy on the breakout or at support. You’d also just need to cut your losses once prices move below the support area. Since the resistance can easily be spotted, that can already serve as your take profits area.

TECHNICALS OF THE TRADE

$BTC at the time was, and still, is in a downtrend. However, prices slowly crept upward as the crypto market stabilized. As the U.S. inflation reporting date drew nearer, Bitcoin prices started to consolidate in a tight range. When the data came out better than expected, prices quickly sprung up. Although a long-lasting uptrend didn’t develop, the opportunity to take a quick swing trade was still there.

Through @style23’s simple analysis, a 6.81% profit in just a few days!

FUNDAMENTALS OF THE TRADE

$BTC was mostly resilient as the 18,000 level held for a long time. However, most tokens came crashing down after controversies emerged. While many are still bullish on the long-term fundamentals of crypto, the bad news still made a dent as prices came crashing down.

WHAT SHOULD BE MY NEXT MOVE

Right now, it doesn’t seem like $BTC will rally strongly anytime soon. Although a bullish divergence formed, it may be too early to expect a reversal of the major trend given the current macro situation and the price weakness shown when the 18,000 level was touched. Ideally, you should wait for the trendline resistance to break and hold first before using trend-following strategies. Until then, it’s best to keep trades short and simple.

Once again, KUDOS to @style23 for being this week’s featured trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.

Got no time analyzing hundreds of stocks or cryptocurrencies one chart at a time? We’ll make it easier for you with our ProScreener!

Try it out today with a 14-day FREE trial.