@apsia2018 takes on the spotlight for this week’s featured trader as he shares his knowledge and insights on stocks from the PSEI.

In a quote by Michael Carr he says “Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets.” His quote perfectly depicts how we should react to the market that we are in right now. With so many uncertainties, we must be able to be ready and adapt to the market situation to win and earn a profit. This is what @apsia2018 has done.

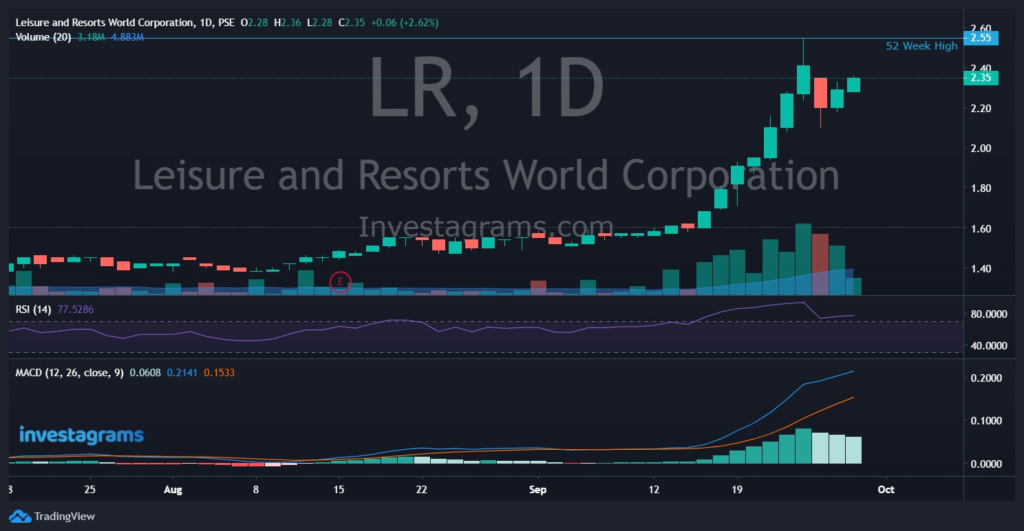

Just recently, @apsia2018 shared his insights on LR about where to take entry and make a profit.

About 16 days ago, our featured trader showed us his thoughts on LR, the possible direction it could be heading, and his long-term plans for the stock. Despite the many uncertainties, @apsia2018 was positive that the stock would skyrocket in the days to come.

During this specific trading period, @apsia2018 has plotted only multiple technical indicators which would help him predict price actions for his trading plan. As we can see, he has included bollinger bands and multiple EMA indicators which allows him to identify the average price of the stock for a specific amount of time. The price, as shown in the chart, is seen to be above all the plotted MA’s indicating an upward trend. He also included the RSI, a momentum indicator that allows traders to identify whether or not a stock is oversold or overpriced. As seen in the chart, the stock is not yet even at its oversold level, indicating that it still had the strength to push the price higher. This allowed @apsia2018 to grab the opportunity and put a call to trade LR.

TECHNICALS OF THE TRADE

Technically, LR at the time was building momentum heading towards an uptrend movement.

At a glance, we may notice that an increase in volume is seen to be taking place with prices slowly rising. We may also notice that RSI, a momentum indicator, was rising as well, which indicated strong buying activity in the market. It was also not at its oversold levels, indicating that it had more chances to go higher. MACD, a trend-following momentum indicator, was also seen to move in a positive direction as it diverges upward indicating bullish momentum. These indicators alone showed great signs of a breakout, which did happen after a couple of trading days. Many of those who grabbed the opportunity were lucky to earn great profits.

FUNDAMENTALS OF THE TRADE

The Leisure & Resorts World Corporation (LRWC) announced that its 2Q 2022 EBITDA was positive. The Company was able to achieve Php 105 million in EBITDA for the second quarter of 2022, a 216% increase from last year’s EBITDA loss of Php90 million. This was made possible by the restart of the majority of its site operations and the introduction of its technology platform.

In the meantime, LRWC’s consolidated revenue increased by up to 250% on an annual basis to Php1.7 billion, producing a gross profit of Php 349 million. Despite its operating expenses more than doubling to Php 244 million, it still reported a net loss of Php 33 million for the quarter, a significant improvement of 85.51% from the 2Q loss of Php 230 million the prior year.

With the quarantine restrictions lifted and the majority of the population adjusting to the new normal, LRWC anticipates continued revenue growth, particularly in its retail segment.

Source: https://edge.pse.com.ph/openDiscViewer.do?edge_no=b60bba0ebcaaee3e3470cea4b051ca8f

WHAT SHOULD BE MY NEXT MOVE

In the daily time frame, LR is seen to be closing into its 52-week high with its current price being very overbought. This could indicate a possible reversal soon causing its price to plunge from its current levels. You may also notice that volume is starting to decline meaning people who bought earlier are planning to sell their positions soon. Moreover, the MACD indicator is showing signs of reversal, though it may not clearly show a cross, the gap is seen to be closing in together.

With the PSEI and economic status being in a bad state, it is best to be very cautious about your trades and the positions you are holding.

There are multiple signs of a reversal for LR, so if you’ve bought earlier and are currently in a gain, it would be best to sell some of your current holdings since the price could drop any time soon. While that is at it, be sure to buy during the dips as the fundamentals of this stock currently show positive outlooks for the future.

Once again, KUDOS to @apsia2018 for being this week’s featured trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.