Let’s give a round of applause to Joselito for being this week’s Featured Trader!

Joselito only joined Investagrams last August 2021. Even though he’s just new to the community, that hasn’t stopped him from being an active member. Regularly posting his own views, he has been a consistent contributor of insights.

Just last week, one of Joselito’s picks broke out and gave traders a quick profit. PSE:APX is a mining company focused on the precious metal gold.

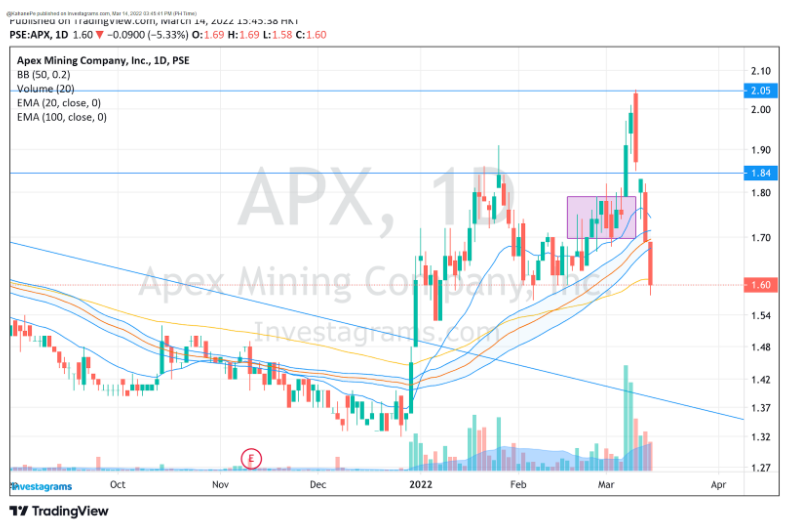

Joselito was eyeing PSE:APX while it was still in a consolidation. One big factor to this breakout was the strong move in Gold. Prior to PSE:APX’s strong move in the local market, there were a lot of buyers in $XAUUSD causing a strong impulse candle to form. That signaled traders to buy into PSE:APX as it is the most prominent mining company of gold in the Philippine local stock market.

TECHNICAL STANDPOINT

In terms of price action, PSE:APX was showing some signs of strength. After breaking out of a long downtrend, prices consolidated for a while. A signal that a breakout might be imminent was when prices started consolidating higher near the long-term resistance. Once the breakout started, the trade was pretty straightforward for traders as the stock price reached the next long-term resistance before coming back down again due to bad market sentiment.

MACRO VIEW

Talking about the trade in PSE:APX wouldn’t be complete without talking about the strong move in $XAUUSD as well. Since mining companies have a correlation with the commodities they are mining, it would make a lot of sense that a strong move in gold would lead to a strong move in PSE:APX.

Technical-wise, $XAUUSD just hit a big resistance level a week before. However, just as Joselito noted in his post, a new all-time high was being expected. Nearly everyone was bullish on gold due to the chaos happening in the global markets, with fears of high inflation looming coupled with the Ukraine-Russia war along with oil prices aggressively rising. The confirmation of a bigger picture move in gold came when prices broke out of the 1950 area and had strong follow through.

Buy the dip? What should I do now?

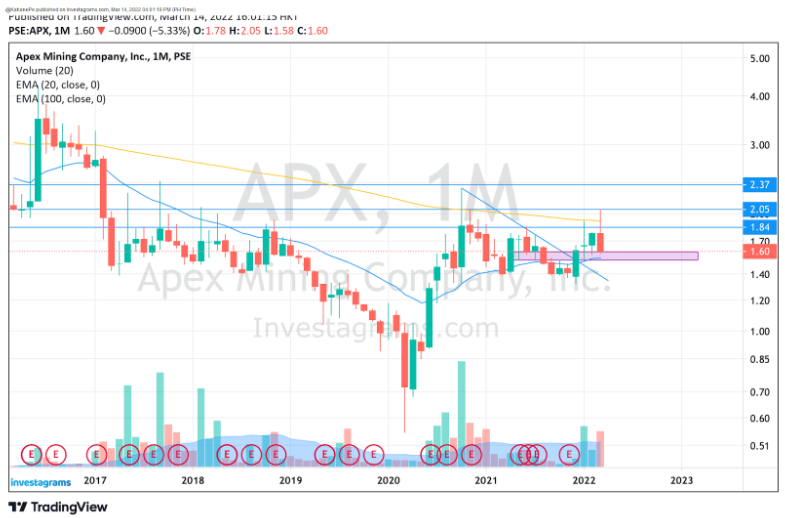

With the recent bad sentiment in equity markets, it wouldn’t really be recommended for people to catch the dip, especially if you aren’t a veteran trader familiar with bounce plays/catching falling knives. One thing that we can recommend is to wait and see how the general market moves in the following days. In the meantime, it would be a good idea to look into the bigger picture of PSE:APX.

Since prices are still trading above the recent multi-month downtrend, we can possibly look for signs of a continuation for the stock before we make a move. There is an inverse head and shoulders pattern forming, but of course we need to wait for confirmation.

Once again, KUDOS to Joselito for being this week’s Featured Trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.