Stock investing requires you to do a careful analysis and research of the company you’re buying stocks from. Part of that analysis comes from the financial data from the business. Crucial to fundamental analysis, financial ratios are relationships determined from a company’s financial information and used for comparison purposes. Although there are multiple ratios, here are some of the most commonly used financial ratios for assessing the company’s value.

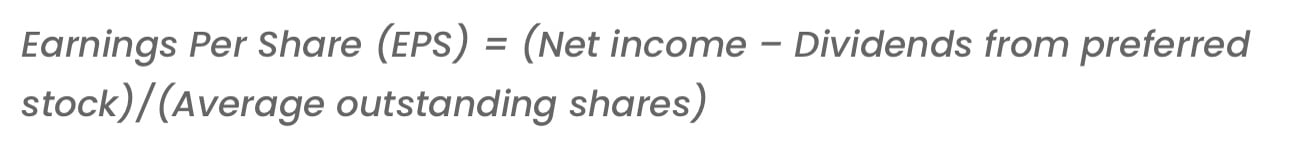

Earnings Per Share (EPS)

Earnings Per Share is basically the net profit that a company has made in a given time period divided by the total outstanding shares of the company. Generally, it is a good sign to invest if the EPS this period exceeds performance from the last time period. It can be calculated on an annual or quarterly basis however it’s important to remember that preferred shares are not included while calculating EPS. This is the most important ratio on this list since EPS is also used in various other financial ratios for their calculations.

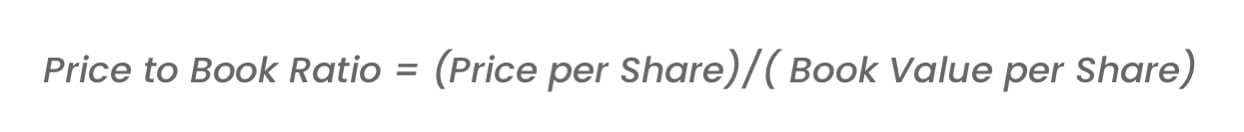

Price to Book Ratio (PBV)

The PE ratio is one of the most widely used financial ratio analysis among investors for a very long time. A high PE ratio generally shows that the investor is paying more than the share is worth and a low PE ratio is preferred while buying a stock. The definition of low varies from industry to industry so you cannot use this ratio to compare a company of one sector and a company from another sector.

Debt to Equity Ratio (DE)

The DE ratio measures the relationship between the amount of capital that has been borrowed (i.e. debt) and the amount of capital contributed by shareholders (i.e. equity). Generally, the higher a company’s DE ratio is, the riskier it becomes to invest in that company since it means that a company is using more leverage despite its weaker equity position.

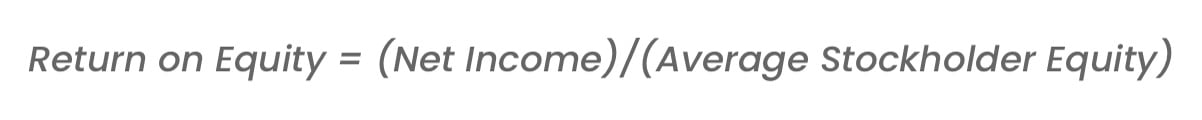

Return on Equity (ROE)

ROE refers to the amount of net income returned as a percentage of shareholder’s equity. The rule with this formula is always invest in a company with a ROE greater than 20% for at least the last 3 years and year-on-year growth in ROE is also a good sign. It measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders for ther investment.

Dividend Yield

If dividends are important for you, then this formula is what you need. The dividend yield gives a better picture of whether the stock being assessed comes from a high or low dividend yielding company. The rule with this formula is that a consistent or a growing dividend yield is a good sign for dividend investors.

It is important to note that financial ratios are time sensitive. They can only present a picture of how the business is doing at the time that the figures were prepared. Though this is not a foolproof method in gaining profit, it is a good way to run a quick check on the company’s financial health to make smart and informed decisions.