“Nakita mo na ba yung bull stock? Parang magbear na siya this week.”

“Nag-IPO na yung negosyo.”

“Gamitin mo lang yung moving average sa mga blue-chip stocks.”

Are these common phrases in the stock market confusing you? This article’s got you covered. These are some essential stock trading terms for beginners.

Bull/Bear Market

Bull and Bear are terms used to describe a stock market or stock trend. Bull, which is often depicted as a bull’s horn pointing upwards, describes a stock or stock market price that is expected or is on the rise. Bear, on the other hand, is the opposite of a bull market. This means that the stock or stock market price is declining or expected to decline.

Blue-Chip Stock

A stock can be recognized as a blue-chip stock if the company it represents is well known, have a good reputation, and often are leaders in their respective industries. Blue-chip stocks are known to deliver superior returns in the long run as well as have consistent annual revenue over a long period. Some examples of blue-chip stocks in the Philippines are Ayala Land, San Miguel Corporation, and BDO Unibank Inc.

Shareholder

A shareholder can be any person, company, or institution that owns at least one stock from the company. Shareholders are essentially owners of a company and therefore, get to reap the benefits of a business’s success in a form of increased stock prices and in some cases, dividends.

Contrarily, if the company loses money, the stock price drops and the shareholder will lose money. Shareholders who own more than 50% of the company’s stocks are known as majority shareholders while anyone with less than 50% is called minority shareholders.

Dividend

As said, some companies offer dividends to their shareholders. A dividend is the distribution of a percentage in the company’s earnings. Dividends aren’t mandatory. This means that the company is solely responsible for deciding what percentage of their earnings go to the shareholders and how often they are willing to give it throughout a year. Dividends, depending on the company, can be paid out in cash or additional stock shares.

Initial Public Offering

An initial public offering, also known as an IPO, refers to the process of turning a private corporation into a public one. Prior to an IPO, the private corporation has a small number of shareholders which usually includes the founders and their family and friends.

The IPO process allows the corporation to issue new stocks for anyone in the stock market to invest in their company. This means that they are willing to open their corporation to the stock market and therefore, offer the company an opportunity to gain more capital.

Moving Average

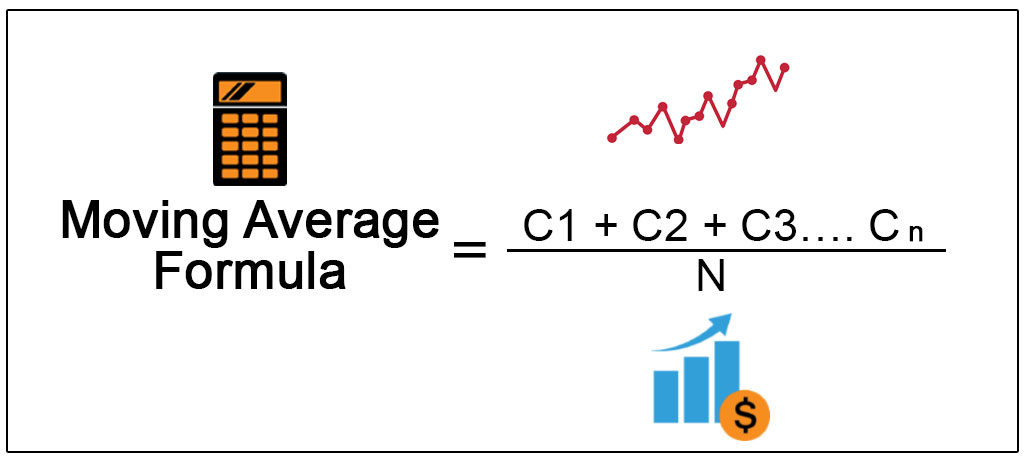

In a mathematical perspective, a moving average is calculated by adding the price of an instrument over a number of time periods and then dividing the sum by the number of time periods, shown in the picture below.

It determines the average price of the given time period, with equal weight given to the price of each period. The moving average is used as a stock indicator, usually calculated to identify the trend direction of a stock or determine its support and resistance levels. Most traders use this because it is based on the historical data of the company which makes predictions more accurate.

Is this article helpful? What other topics you want us to write about? Help us improve our content so we could serve you better. Comment down your thoughts, mga Ka-Investa!