Amidst the rise of the local index, more names have emerged as potential market leaders. It is expected that more would flourish once the 6500 levels breach. With that being said, several names have shown signs of strength before the imminent breakout of the said levels.

Blitzkrieg (@blitzkrieg08) successfully spotted one of those stocks — Shakey’s Pizza Asia Ventures, Inc., or $PIZZA. This trader is an active member of the Investagrams community who endlessly provides his analysis of local stocks with the use of Technical Analysis.

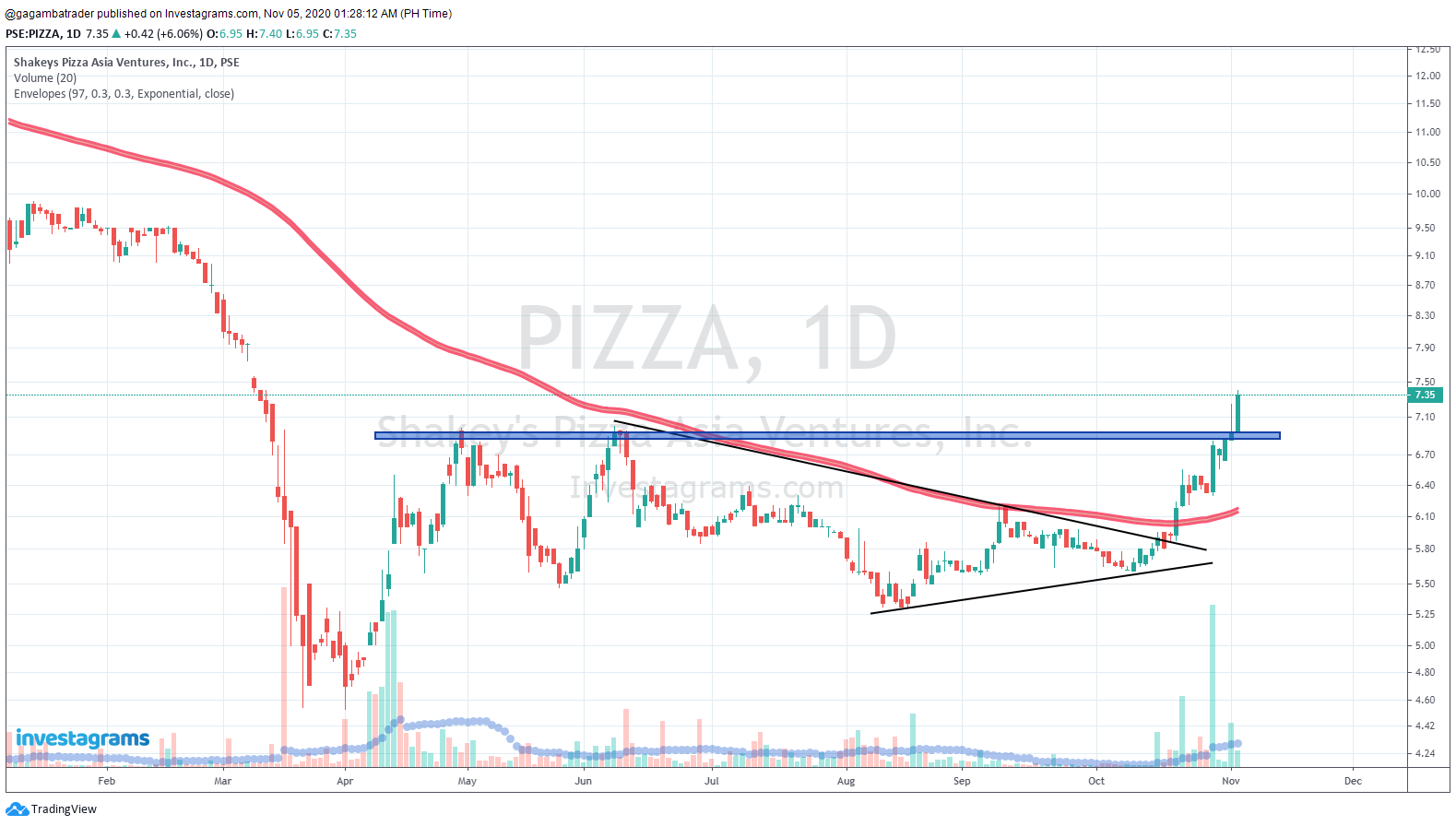

The said name formed a long consolidation phase that started back in April 2020. As seen in the chart, the said phase was accompanied by dried up volume. Once the breakout occurred, it was supported with such volume activity that was last exhibited before the consolidation period in April 2020. The said up move was also in confluence with the breach of the 200-day moving average, that further validifies its current trend.

Besides the breakout of the pivot high at around the 7-peso area, a triangle breakout also happened in confluence with the 100-day moving average around the 6-peso area. The said scenarios could have been a flawless tranching setup.

It is a low-risk, high-reward trade, as the stop loss levels for the said breakout point of the triangle pattern is around 5.74 (-4%), and the take profit areas could be the structural resistance at 7 to 8 peso area (17% to 30%). Moreover, the stop-loss levels for the said breakout of the pivot high at the 7-peso levels could be around 6.65 (-5%), and the take profit levels of such would be 8 to 9-peso area (15% to 29%).

$PIZZA must hold its ground around the 7-peso levels to further solidify its stance. The said stock should form a consolidation phase to provide some sort of leverage in its state before it reaches its structural and psychological resistance levels. Indeed, the rise of the $PSEi boosted this stock’s plight.

It is a non-negotiable for traders to accept the fact that every moment in the market is unique, therefore it is imperative to manage one’s expectation in a certain trade. Hence, exempting proper risk management to mitigate potential hazards is a deadly sin for traders and investors.

Congratulations to those who were able to maximize $PIZZA’s monstrous move. Lastly, kudos again to Blitzkrieg (@blitzkrieg08) for sharing his trade analysis. Your FREE 1-Month InvestaPRO is on its way!