So you’ve been trading in the Philippine market for a while now, and feel like it’s time to start diversifying your trade portfolio.

You think to start trading in international markets — it’s a good opportunity, and it doesn’t seem too difficult!

However, the more you think about it, the more you realize how little you know about how it works — what exchanges should you be looking at? What are the most stable? How do I start trading? With all these questions swirling in your mind, it’s easy to get daunted and never really begin your venture into international markets. You realize that you may need a little guidance when it comes to entering those markets — well, look no further! This article takes you into the world of international trading, and watch out for more from the Going Global series to fully understand these foreign markets.

Get ready to kickstart your journey and start taking your stocks globally.

International Stock Exchanges

Almost every developed country has its own stock exchange: the Philippines has the PSE, China the Shanghai Stock Exchange, and many more. Each stock exchange is composed of companies that are locally listed and traded on the exchange. Among the most prominent stock exchanges in the world are the New York Stock Exchange, the NASDAQ, Tokyo Stock Exchange, and London Stock Exchange. Let’s take a closer look at each below:

1. New York Stock Exchange

The NYSE is the largest exchange in terms of total market capitalization. It dates back to 1972, and most of the largest American companies are listed here. It used the NYSE Composite Index to monitor stock activity. Additionally, foreign-owned companies may also list their shares on the NYSE, as long as they adhere to some specified listing standards.

2. NASDAQ

Short for National Association of Securities Dealers Automated Quotations, NASDAQ is the exchange for many electronic companies such as Apple, Microsoft, and Amazon. It is headquartered in New York City and was the first stock market in the United States to trade online in 1971.

3. Tokyo Stock Exchange

The Tokyo Stock Exchange is the most prominent of Japan’s five stock exchanges. It uses the Nikkei 225 Stock Average, a price-weighted index composed of Japan’s top 225 blue-chip companies. These companies are selected by the Nihon Keizai Shimbun, Japan’s leading business newspaper.

4. London Stock Exchange

The London Stock Exchange was founded in 1801. It utilizes the Financial Times Stock Exchange 100 Index, nicknamed the “Footsie”, which lists the top 100 companies in the London Stock Exchange with the highest market capitalization.

Why should I invest internationally?

Individuals usually invest internationally for two main reasons — to diversify their investment portfolio and take advantage of the growth of other countries. It is often wise to spread the risk of one’s investments across many companies and markets, as to not be overly reliant on the market conditions of just one area. As such, by diversifying one’s portfolio, one will be able to mitigate risks posed by economic, political, and social events of a country. Additionally, buying stocks in another country is a great way to take advantage of the growth they are experiencing. If a specific country is seeing great growth, investing in companies listed there will allow one to partake in their advancements.

However, there are also some risks that come with investing in foreign markets. Firstly, in order to invest internationally, you must work with a registered broker, as compared to being able to do so on your own in Philippine markets. This incurs additional costs, as you will have to pay commission fees. The fluctuating currency rates may also affect your investment positively or negatively, depending on whether the rate is going up or down. The currency rate will directly affect how much profit you are able to gain from your investment, which can go both ways. Lastly, there is the risk of having an inadequate understanding of political, economic, and social conditions in the country you are investing in, which will affect stock prices. Being hundreds or thousands of miles away from where you are investing your money makes it difficult to have a firm understanding of its market conditions, possibly leading to less informed decisions regarding your investments.

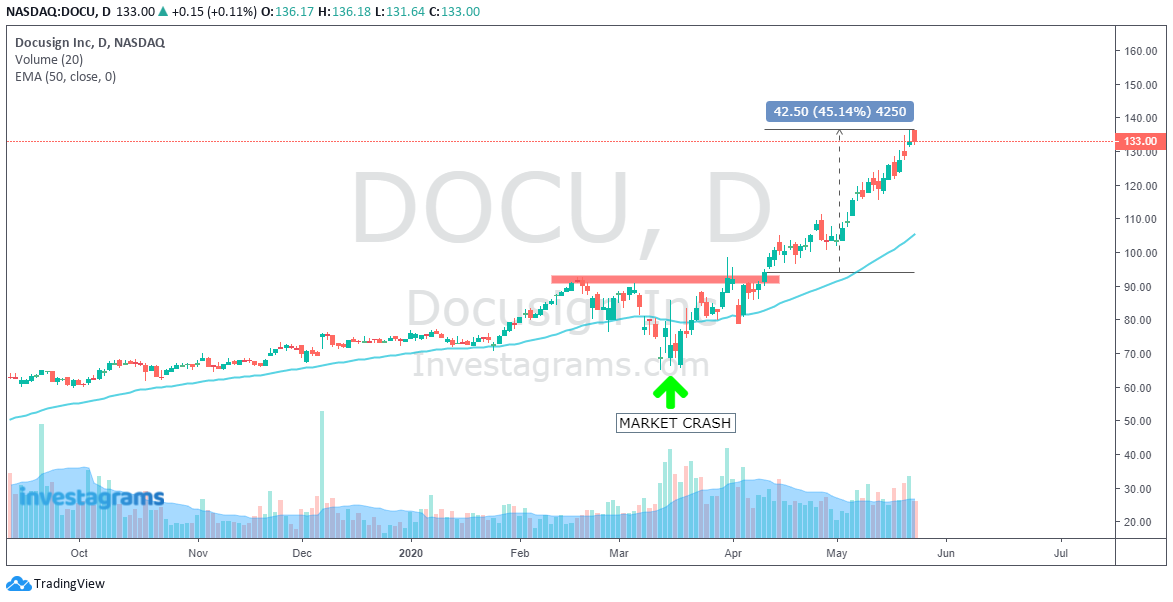

US Stocks vs Philippines Stocks since the market crashed

Just to show the difference between the US stock market and the Philippine stock market after the market crash we’ll be showing you guys the vast difference of opportunities on both markets. After the initial recovery, there were a few weeks where some stocks in the Philippines showed strong reversals like $MAXS, $IDC, $MAH, $JFC, $URC, $AC, $MRSGI, $PGOLD, and the like. However, only a few names went on to go up 30% or more. The stocks that made a strong move after the low at 4,000 levels are probably only a handful, and very rarely does everyone have the opportunity to capitalize on them.

However, while all the Philippine market had been reversals, the US stock market had hundreds of stocks close to making a new 52wk high and all-time high. A new breed of market leaders were already showing up in the global markets, while only a few stocks remained resilient and did not make news lows during the crash here in the Philippines; specifically, $GLO and $TEL.

Stocks in the US like $ZM, $SE, $WIX, $DOCU, $SHOP, $SGEN, $PYPL, $OKTA, $NFLX, $MASI, and so much more went on to make new highs. Here’s a look at a few of their charts as of May 26, 2020.

Conclusion

With all this being said, investing in foreign markets is still a good and profitable way to diversify your portfolio. It is recommended that 5-10% of your portfolio be foreign investments, with the majority still being from locally-listed companies. Before venturing into the international markets, it is best to be well-informed of the benefits and risks of doing so and to start investing confidently in your knowledge of foreign markets and its implications to your investment portfolio.

Watch out for more from the #GoingGlobal series of articles to further enhance your understanding of investing in foreign markets!

The Going Global series aims to introduce traders, whether beginners or advanced, to the international stock markets. Throughout this series, we will explore the pros and cons of international investing, how to kickstart your international portfolio, and many more tips to navigate this more complex trading world.