One of the key lessons that Mark Minervini teaches in his book “Trade Like a Stock Market Wizard” is the concept of counting bases. Minervini only buys stocks that are in what he calls a Stage 2 or Uptrend, or the advancing stage. This is where stocks create explosive moves that can help a trader create the most amount of money or possible gain in the shortest amount of time.

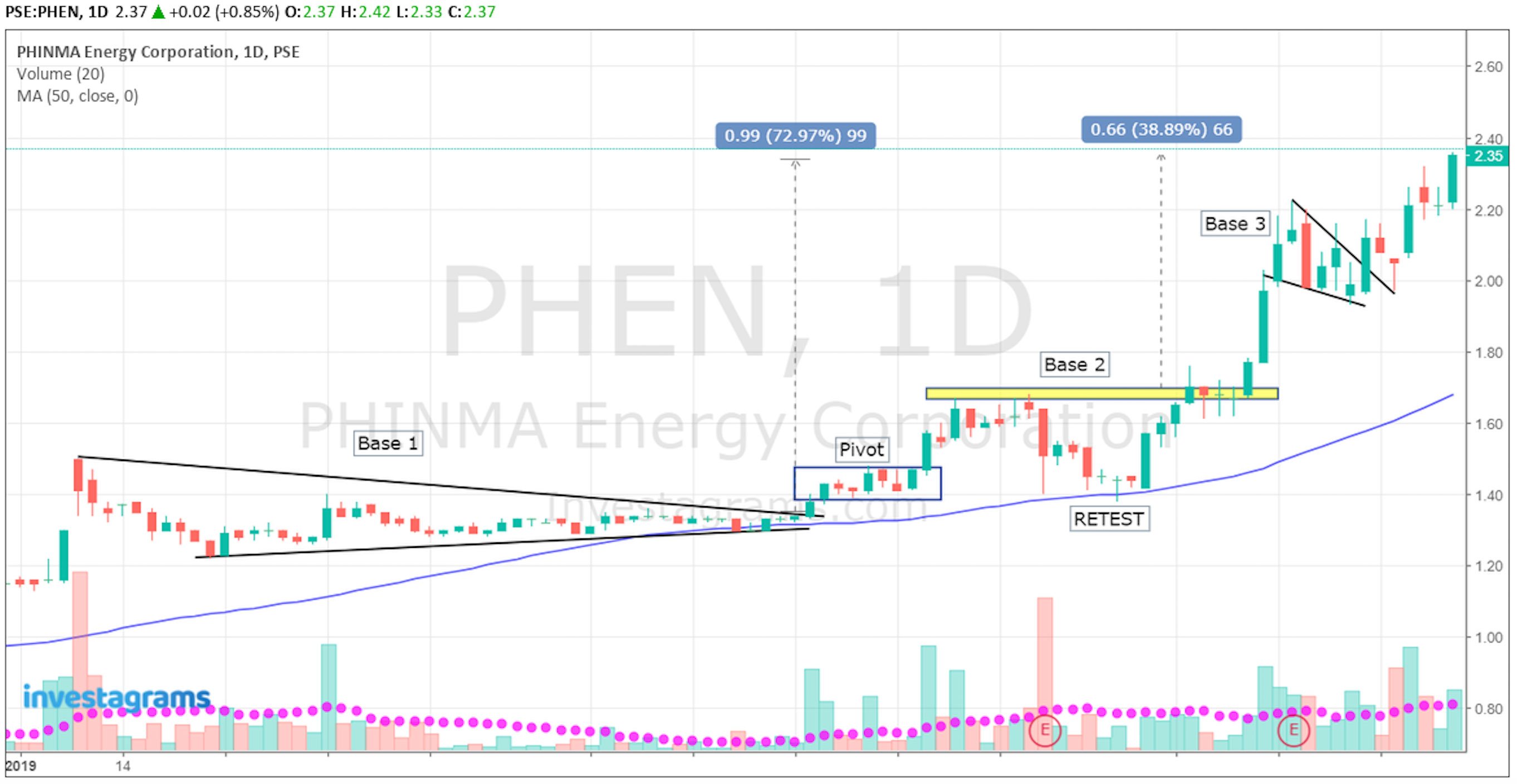

Within a Stage 2 Uptrend, assuming the stock doesn’t get extended too early, are bases. Minervini states that the best time to get into a stock that’s in a Stage 2 Uptrend is during the 1st or 2nd base. At this point the stock isn’t on the public’s radar yet. Once a stock makes a third base that’s when it’s obvious to the general public that the stock is trending strongly, but an entry at this level is still acceptable. If a stock reaches a 4th or higher base, it’s prone to deep pullbacks and it not advisable for entry.

Learning the concept of counting bases will allow you to time your entries during the 1st or 2nd base. Also, knowing when a stock is at a 4th or higher base can be a signal that it’s time to sell into strength.

Base counting is somewhat subjective, so there’s no perfect way of doing it – as always, practice to get better and challenge yourself to learn more.

Here are a few examples:

BUT TAKE NOTE!

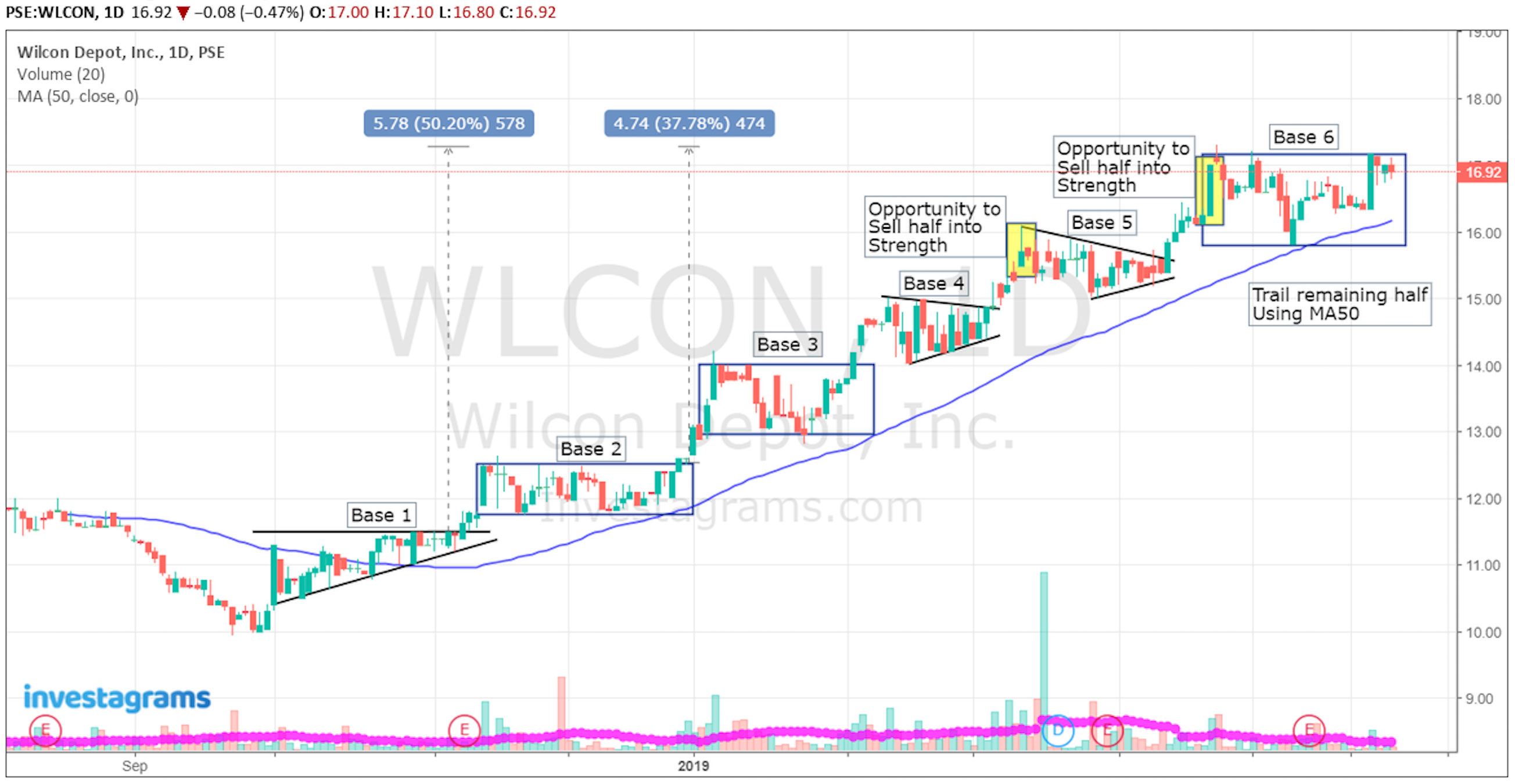

Just because a stock has reached a 5th base doesn’t mean a stock can’t make even more bases. The importance of base counting is not selling on a 4th or 5th base, rather, it’s just like an “FYI” for you to know where the stock is in its 2nd Stage Uptrend. Stocks that have made a 4th or 5th base can be prone to deep pullbacks and knowing this is very significant to your selling.

Also, when a stock is in a late stage base (4 and above) it can go through what is called a climax run-up or climax top. This is when a stock just goes crazy euphoric and the prices spikes up maybe 10, 20, or 30% in one day! This is a golden opportunity to sell into strength.

By knowing that a stock is in a late stage base, especially if you’re in a tail end of a bull market, can allow you to sell half of your position into strength if ever the stock breaks out, them simply trail the remaining half using MA20 or MA50.

It’s important to have a plan to selling either into strength or into weakness (using a trail stop) Here’s the thing however, if you sell into strength you’ll usually sell too early, and if you sell into weakness you’ll usually sell too late. Well, that normal. You’ll never be able to pick the tops and bottoms on a consistent basis; the goal is to sell at a price higher than the price you made your purchase.

Few more samples below:

FINAL THOUGHTS

Always remember, counting bases is not used as a selling technique; it’s a way to identify where a stock is within it’s longer term Stage 2 Uptrend. If a stock is in an early stage base (1-2) it’s the best opportunity to purchase the stock while it’s still not on the public’s radar. If a stock reaches base 4 and above is not an outright signal to liquidate your position, it’s a signal that you should be more cautious with your position and always be ready to sell either into strength or weakness.