There has been news going around lately that the Philippine Stock Exchange (PSE) might finally allow short selling in 2018, resurrecting a plan that has been in the works since 2009. Whether or not the plan will push through is another story, but if it does, you need to be ready.

In this article, we’ll explain the basics of short selling, our advice, and how you can prepare yourself for the shake-up that might be coming in a few months.

What is Short Selling?

Short selling, also known as taking a short position, is when a trader sells a stock at a higher price before buying it at lower price—sell high, buy low. It’s just the opposite of taking a long position, where you buy low and then sell high.

Now, we know what you’re thinking. How the heck can you sell a stock before buying it??

The answer to your question is simple: you borrow shares. In other words, umutang ka muna. Sell those borrowed shares first. After that, you just have to buy shares to replace the ones you borrowed.

What Short Selling Means for PSE Traders

Most traders in the PSE always take the long position simply because it’s the only option available. For years, we’ve meticulously researched and developed systems to find and profit from stocks that are expected to increase in price.

We’re used to ignoring stocks with prices that are about to go down. After all, you can’t make money with those, right? Well with short selling, you can!

If you know how to use both the long and short positions, you can make money from stocks that are going up and from stocks that are going down! You will essentially double your opportunities in the stock market. Of course there are also risks involved, but if you keep learning and stay disciplined then there’s no reason why you can’t succeed.

Our Advice

In the stock market, those that keep learning, trying new things, and improving themselves are the ones who succeed. None of us know for sure if short selling will really be allowed in 2018. But no matter what happens, you should still read about it and prepare yourself if you haven’t already.

Besides, you’re already doing the work anyway. The same research will tell you if a stock’s price will go up or down. Why not give yourself the opportunity to earn from both scenarios instead of ignoring half the opportunities?

We’re not saying you have to put 50% of your portfolio in the short position—not at all! After learning about short selling, you might even decide that it’s just not for you and that would be fine. But either way, you need to understand it first. Even if you don’t end up using it, you need to know what it is and how it affects other traders and the markets.

Try Before You Buy!

They say experience is the best teacher. So even before short selling is allowed in the PSE, you can already start practicing! See and feel what it’s like to trade from the short position using the Investagrams virtual trading platform. Just follow the 3 simple steps below to activate the feature:

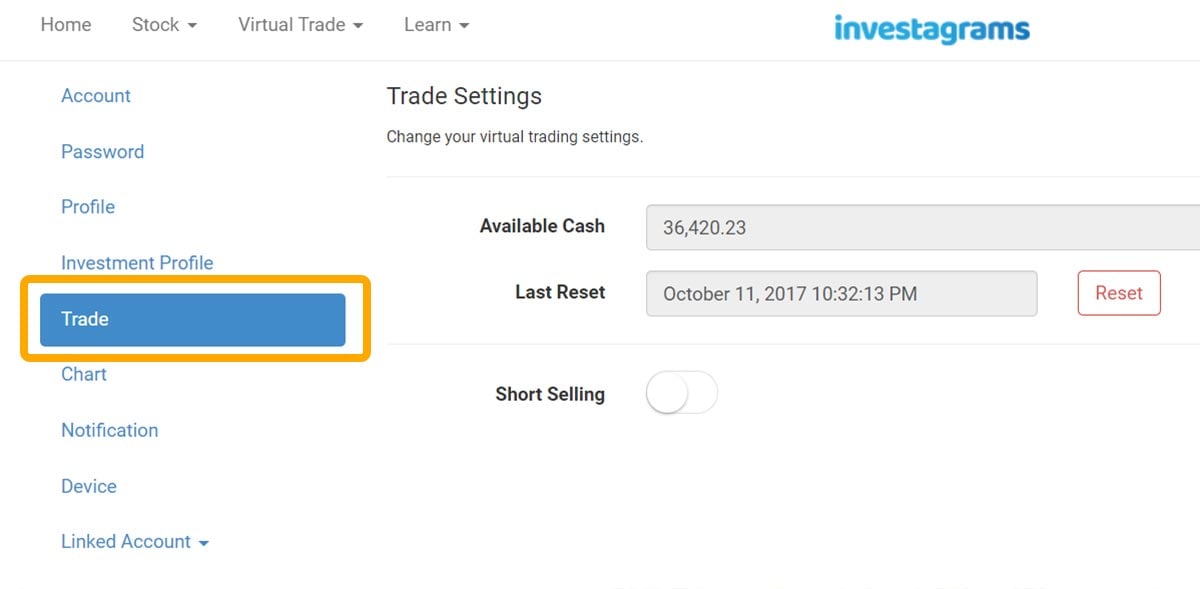

Step 1: Go to your trade settings.

Click on your profile icon on the upper right of the homepage and select “Settings” from the drop down menu. When you’re on the Settings page, click “Trade” on the left navigation.

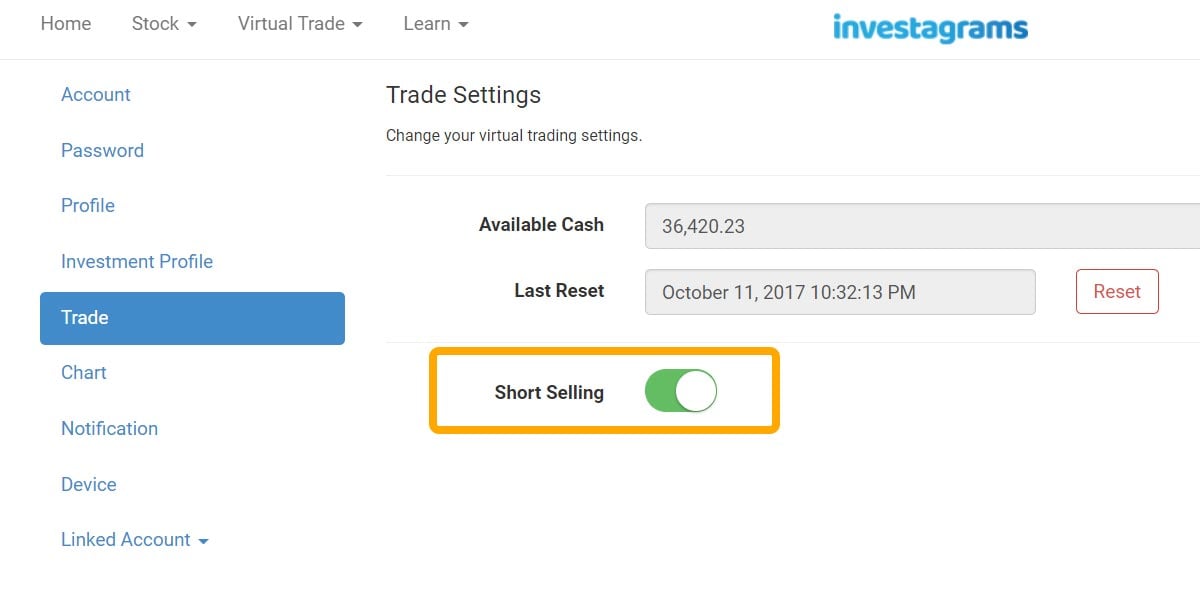

Step 2: Turn on the short selling feature.

Simply click on the toggle button to turn on the short selling feature. Your new settings will be saved automaticallly.

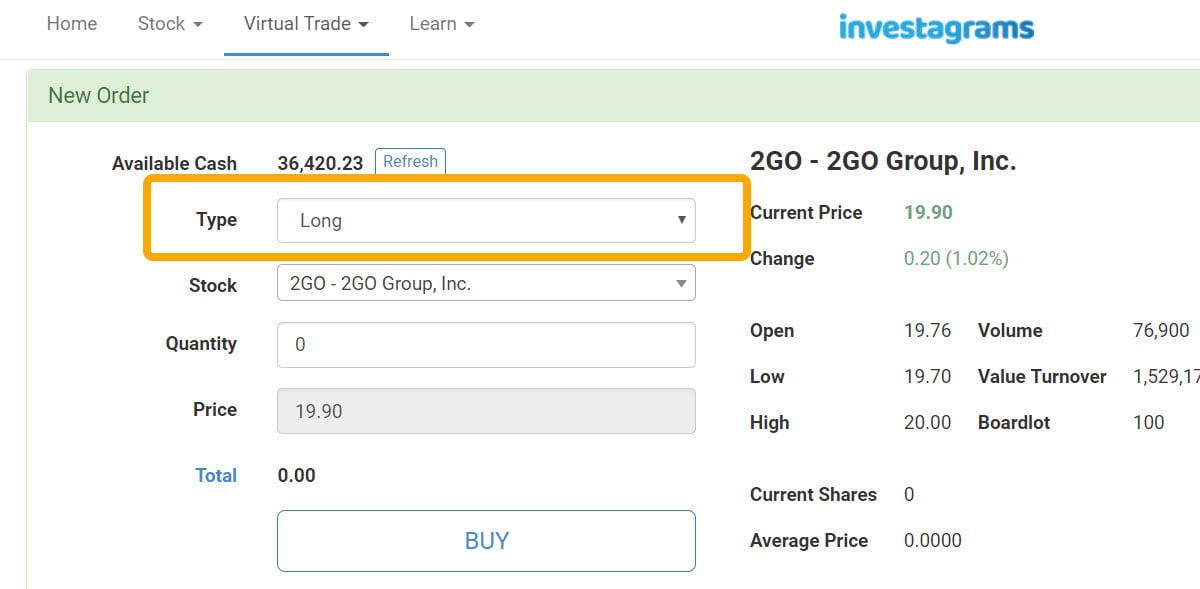

Step 3: Start trading!

When you go to your virtual trading account, you will now be able to choose if you want to trade from the long position or the short position.

Simple, right?

We hope this helped you understand what short selling is and how you can be prepared if the PSE allows it in 2018. If you have more questions, just leave them below!

For more investing tips and stock market advice, subscribe to InvestaDaily. You can also sign up for Investagrams to access free features to help you on your stock market journey.