Technical analysis is a term that we hear a lot in the stock market. But what does it actually mean and how can it help you with stock trading? Today, we’ll cover the basics and tell you everything you need to know.

What is Technical Analysis?

Technical analysis (TA) is the use of past market data to analyze stocks and make better trading decisions. It’s based on the idea that supply and demand will determine a stock’s price more accurately than the company’s intrinsic or “true” value.

Technical analysts look at the price movement over time, trading volume, and other historical market data. Then, they find trends and patterns which can be used to predict future price movements.

It can seem complicated at first, but many traders actually find it easier than its counterpart, fundamental analysis. It’s less subjective, involves less research, and can be used even if you don’t know a lot about the industry or company.

**To read more about fundamental analysis vs. technical analysis, click here.

The 3 Assumptions of Technical Analysis

Technical analysis is very popular, especially for traders who like short-term investing. But it’s important for you to understand it well before risking your hard-earned money. Before you go all-in, here are the 3 main assumptions in TA that you should know:

1. The market discounts everything.

This is one of the strongest assumptions in TA. Here, we assume that all publicly available information is already “priced-in” or reflected in the stock price.

Our assumption is that when market players get information, they react to it by either buying or selling shares. Because of this, supply and demand will immediately adjust along with the stock’s price.

Any news, disclosures, or announcements won’t matter anymore because the market is always a step ahead. You can never have any “new” information that the market didn’t already account for,

2. Prices move in trends.

Technical analysts believe that price movements are not random. They will always move in some general direction, whether upward, downward, or sideways.

For example, if a certain stock’s price is increasing, then it is more likely that the price will continue to increase. If the price is going down, then it is more likely that the price will continue to go down.

The trend can be short-, medium-, or long-term, but prices always tend to move in one direction and are more likely to continue that trend rather than move randomly.

3. History repeats itself.

People behave in a predictable way. Because of this, similar events and information are usually met with similar reactions. Bad earnings will make people want to sell, expansion plans will make people want to buy, and so on.

This allows us to use past market data and chart patterns to predict future price movements and market behavior.

Basic Concepts in Technical Analysis

Now that you know a bit more about technical analysis and the assumptions behind it, let’s cover some of the basic concepts in TA. Each of these concepts can be a full article on its own, but for now we’ll just run through the most important facts to get you started.

1. Support and Resistance

Support and resistance are two of the most basic concepts in technical analysis. You can already use them to make trading decisions, but they also form the foundation of more complex strategies and trading systems.

Support is the price that, historically, a stock has had difficulty falling below. This is the point where the market considers the price to be “cheap”. Demand becomes so strong that it stops the price from going any lower. In other words, marami nang gustong bumili kaya ‘di na masyado bumababa yung presyo.

Resistance is simply the opposite of support. This is the point where the stock price usually starts going down because there is too much supply and not enough demand. Masyadong marami nang gusto magbenta kaya bumababa yung presyo.

Support and resistance levels are not always precise and they can be broken, but it’s a simple and proven concept that many find useful. The basic rule when trading using support and resistance is to buy on support and sell on resistance.

2. Trend Analysis

There are always going to be ups and downs in the stock market and in every stock, but these ups and downs will eventually form a trend that moves in some general direction—this is actually one of the key assumptions of TA that we discussed above.

There are 3 basic types of trends:

Uptrend

Identified by a series of higher highs and higher lows. The general movement over time is going upward.

Downtrend

Identified by a series of lower highs and lower lows. The general movement over time is going downward.

Sideways

There is no clear pattern going upward or downward. The general movement over time is horizontal or flat.

Similar to support and resistance, trends are not guaranteed to continue to hold. That’s why they can be further classified into short-, medium-, and long-term trends. Trends can and do change. But unless something happens to change the market behavior, then the trend is likely to continue.

The general rule of thumb? Buy stocks on an uptrend. Avoid stocks on a downtrend.

3. Volume

A lot of technical analysis involves looking at the stock price, but that’s not the only important statistic in TA. Another equally important, if not more important, number to look at is the trading volume.

The trading volume tells you the number of shares that were bought and sold in a particular time frame (usually a day). You can see the volume shown as a bar graph at the bottom of the stock chart.

Volume is important because it gives context to price movements. It tells you how strong or weak a trend or chart pattern is.

For example: If the price of a downtrending stock starts going up, does it mean the trend changed to an uptrend? Take a look at the volume and you’ll find out. If the volume is low, then the trend will probably continue going down. If the trading volume is high, it means that there is a strong demand for the stock and the trend will likely change to an uptrend.

The rule of thumb? Kung high volume, push mo na. Kung low volume, ingat muna.

4. CHART PATTERNS

There are many kinds of charts that traders can use to monitor the stock market, but the most popular is probably the candlestick chart.

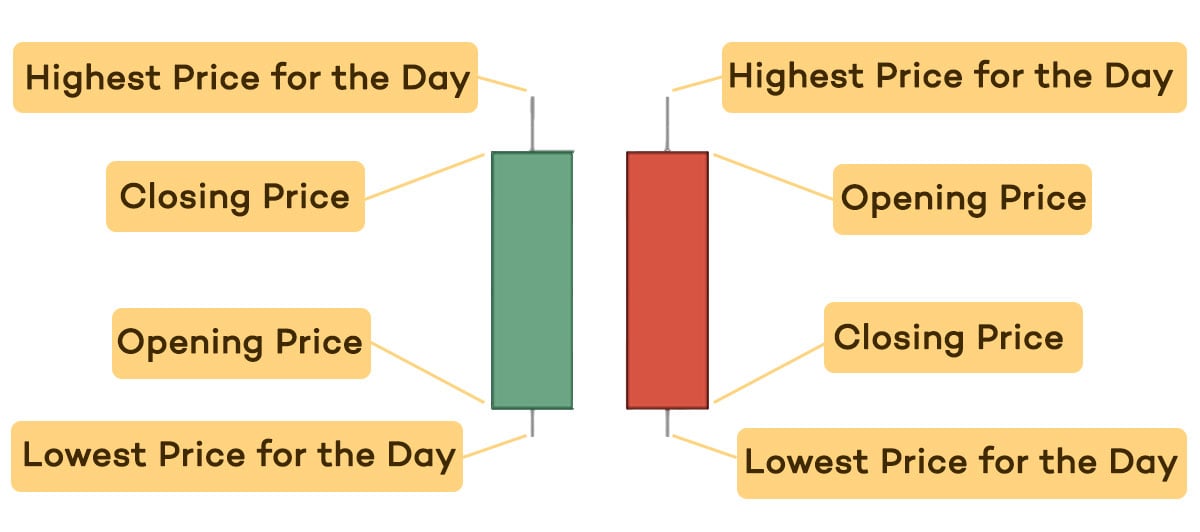

A candlestick chart shows four key prices for the day—the opening price, closing price, highest price, and lowest price. These are based on that day’s completed transactions.

If the candle is green, it means that the closing price was higher than the opening price. If it is red, it means the opening price was higher than the closing price.

The colors might change depending on the chart you’re using, but one color will always show an increase in price over the day and another color will show a decrease in price.

Once you understand how to read charts, then you can also start seeing patterns forming. Because TA assumes that history repeats itself, we can use past patterns to predict future movements in the market.

Here are some basic chart patterns:

Head and Shoulders

A “head and shoulders” means that there are 3 peaks in your chart pattern—the middle peak is the highest (head) with two relatively equal lower peaks beside it (shoulders). This pattern signals a trend reversal, with the line connecting the two “shoulders” as the key support level to watch. If you see the price break below that level, expect a trend reversal or breakdown of the stock. An inverse head and shoulders may also signal that a downtrending stock is about to change to an uptrend.

Cup and Handle

A “cup and handle” forms when, after an uptrend, the chart forms a large U-shaped curve (the “cup”) followed by a smaller dip before continuing upward (the “handle”). This pattern signals that the the stock is bullish. If the pattern is completed, the price will likely resume its previous upward trend. If the right side of the handle breaks above the peak formed between the cup and the handle, it confirms that the pattern is complete and that the uptrend will resume.

Double Top or Double Bottom

A “double top” or “double bottom” forms when a stock hits its existing support or resistance level two times without breaking through. After the second peak or valley, watch out to see if the chart breaks the key support or resistance level. If it does, you will likely see it continue all the way up or down, forming a trend reversal.

5. Moving Averages

There are many types of moving averages used in technical analysis, but they all have one intention—to remove day-to-day price fluctuations and make chart analysis easier. Moving averages allow us to plot smoother lines that show trends and patterns more clearly.

One of the most popular types of moving averages is the simple moving average (SMA). We’ll focus on this for now.

To find the simple moving average, just get the sum of all the prices in a certain period and divide it by the number of prices you added up. The most common periods used in TA are the last 20, 50, 100, or 200 trading days but you can really use any period you want.

You can use these moving averages to determine support and resistance levels and to identify trend reversals.

A long-term moving average, like the 200-day moving average, is often used as a basis for the stock’s support or resistance. It shows the general trend that the stock has been moving in.

A short-term moving average, like the 20-day moving average, shows how the stock is performing now . When compared to the long-term moving average, it shows to how the stock is performing compared to its past performance.

If the short-term SMA line rises above the long-term SMA line, you should buy stocks because it means the trend is going upward.

If the short-term SMA line falls below the long-term SMA line, you should sell your stocks because it means the trend is going downward.

Conclusion

We talked about a lot in this article, but we barely scratched the surface of technical analysis! As you practice trading, you will learn how to combine these concepts and turn them into practical and useful trading strategies.

Stay tuned as we dive deeper into each of the concepts in our next articles and subscribe to InvestaDaily for more investing tips and stock market advice!

In the meantime, try applying the concepts above in your trading! Leave your comments below and update us on how you’re doing. 🙂