We all know that there is money to be made in the stock market. Big corporations and retail traders make millions from the market every day! But how do they do it? And how can a regular Filipino do the same? Where do we even start?

The stock market can seem very complex, and sometimes it is! But don’t let that intimidate you. Just like with any other skill, you have to start with the basics first. Walk before you try to run. Keep making improvements, no matter how small, and you’ll reach your goals before you know it!

There are literally thousands of trading strategies being used around the world, but you don’t have to (and you shouldn’t) be using them all. Start with one simple strategy before trying more advanced tactics. Learn what works for you and what doesn’t, and slowly but surely you’ll see results.

In this article, we’ll help you take that first step by explaining some basic principles along with two simple strategies that you can use to start trading in the stock market. Ready? Let’s get started!

BUYING LOW AND SELLING HIGH: WHAT IT MEANS AND HOW IT’S DONE

When asked, “How can I make money in the stock market?” a lot of people say that “It’s simple. Just buy low and sell high.” Well, of course! No one is going to make money by buying high and selling low. That’s just common sense. But how can we buy low and sell high? There is no crystal ball to tell us what the future holds or how the market will move, so how will are we supposed to know whether the current price is low or high?

Well, the good news is that you don’t need a crystal ball or a time machine to see into the future—you just need to understand the concepts that trigger movements in the market. The better you understand the forces that shape the market, the more often your predictions will be right.

THE BASICS: SUPPLY AND DEMAND

In one way or another, everything that happens in the stock market is a result of supply and demand reacting to one another. There are a limited number of stocks, so if a stock is in demand and more people want to buy it compared to those who want to sell, then the price goes up. The opposite happens when more people want to sell and fewer people want to buy.

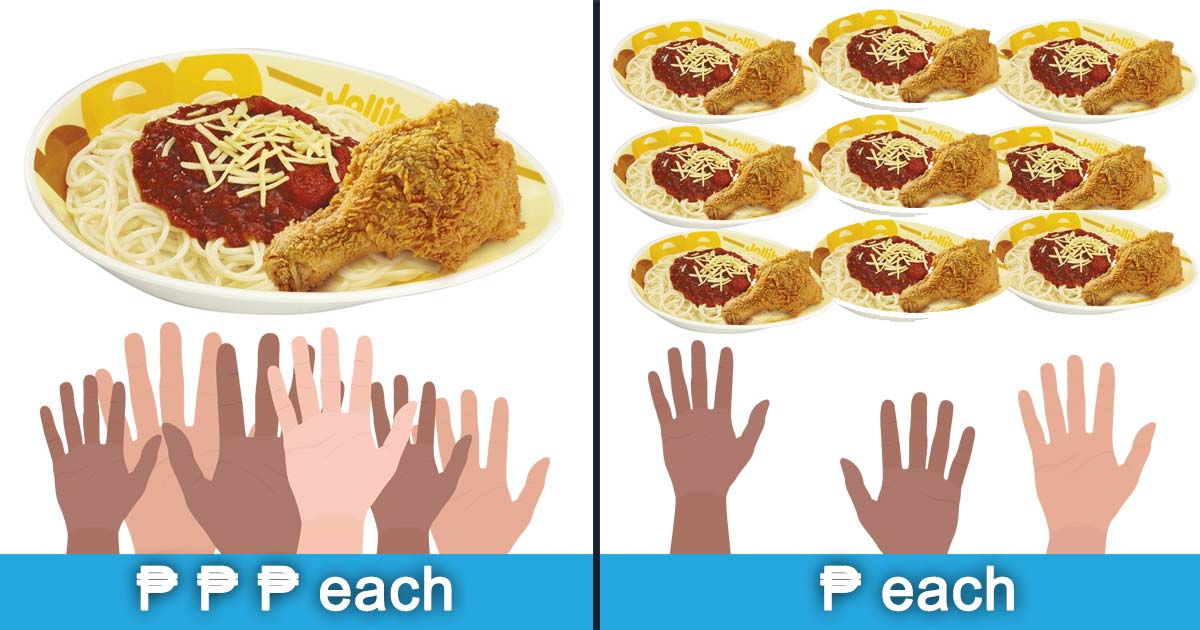

Think of it this way: A 1-pc Chickenjoy costs P89 right now. But what if that 1-pc Chickenjoy was the last one on earth and everyone wanted to eat it? How much would people be willing to pay for that? On the other hand, if there were mountains of Chickenjoy everywhere you look, would you still pay P89 for it? Probably not. It sounds funny, but the entire stock market functions on basically the same principle.

People want to buy and sell stocks for many reasons. Whatever those reasons are, they will cause either a stronger demand or supply. This will be reflected as an increase or decrease in price. So how does this help you see into the future? Simple. You just need to be able to identify the signals and triggers that indicate when a rise in supply or demand will come. All stock trading strategies, from the most simple to the most complex, are based on this idea.

BASIC STOCK TRADING STRATEGIES FOR BEGINNERS

Disclaimer: Before you read about the two basic strategies below, you should first understand the two schools of thought behind these strategies: Fundamental Analysis and Technical Analysis. You might want to first read about some basic stock trading terms here.

STRATEGY 1: VALUE INVESTING

Commonly described as “buying a business,” this strategy relies heavily on fundamental analysis. In this strategy, we assume that the market price will eventually become equal to the intrinsic value of the company. The basic principle here is to identify stocks whose market value is less than its intrinsic value. When you buy an undervalued stock and the market price corrects itself, that is where you make your profit.

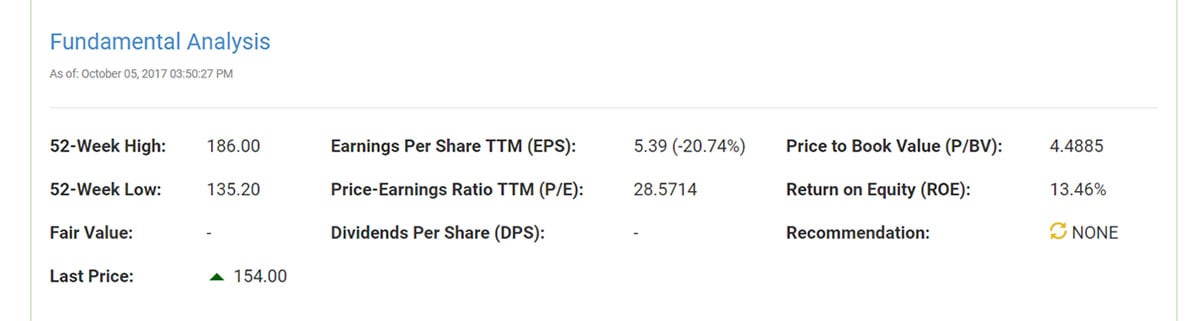

There are many indicators and formulas people use to identify the intrinsic value of a company, but one of the simplest and most popular indicators is looking at the price-to-earnings or P/E ratio. To get the P/E ratio, just divide the price of the share by the earnings per share. Value investors will compare the P/E ratios of companies within or across industries to identify undervalued stocks. For example, if you see that the average P/E ratio for a company in the logistics business is 10 but one company has a P/E ratio of 5, then you may want to invest in that company.

There are many other indicators that you could use, but this is one of the most basic. Keep in mind however that a low P/E ratio is not always a good thing. Low prices could also mean there’s trouble inside the company, and that the value will continue to go down. That is why it is important to do thorough research after identifying potentially undervalued companies. As the name suggests, traders that use this strategy have to look for a good business with real value. Act as if you are becoming part-owner of that business, because that’s essentially what you are doing!

Other similar strategies that also use fundamental analysis are Growth Investing, Income Investing, CANSLIM, and more.

STRATEGY 2: MOVING AVERAGE CROSSOVER

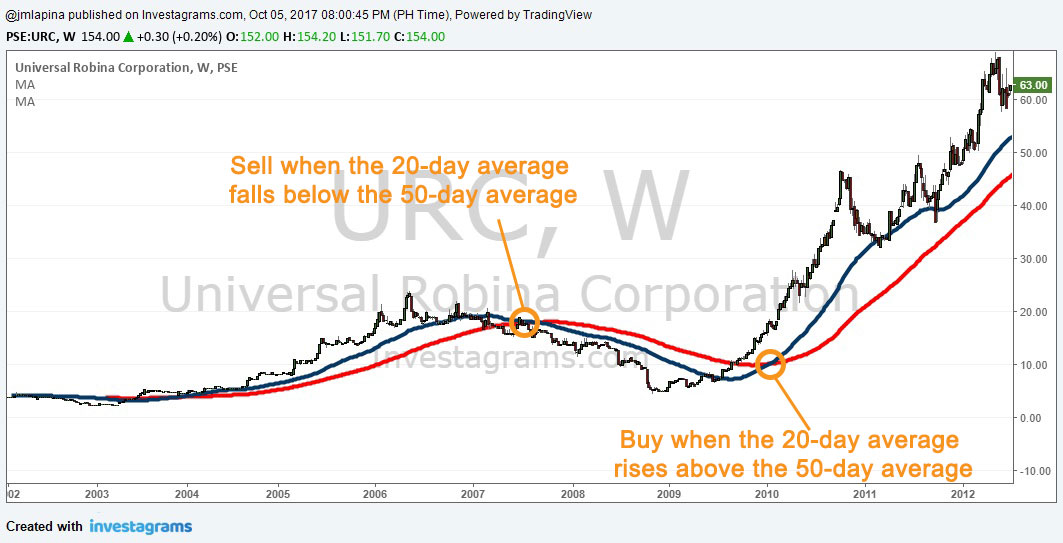

On the other side of the spectrum, we have the Moving Average Crossover Strategy which an approach based on the principles of technical analysis. Here, we rely on patterns and data available in the market to predict future movements and make trading decisions. Your aim is still to buy low and sell high, but you are using different indicators and signals to do it.

To implement the Moving Average Crossover strategy, you simply have to monitor two moving averages: the 20-day moving average and the 50-day moving average of a particular stock’s price. If the 20-day average becomes higher than the 50-day average, it means that the price is going up and you should buy shares. If the 20-day average falls below the 50-day average, you should sell because it means the price is going down. Sounds simple, right?

Many find this type of strategy easier to implement because it is very objective and there is very little chance of becoming emotional. It also requires relatively less research compared to Value Investing, so it’s less intimidating for a beginner. However, you should remember that at the end of the day it is always good to understand the logic behind the numbers. The “rules” in any trading strategy are never fool-proof. There are times when they will be wrong, and understanding the sentiment behind the market’s behavior can only help you make smarter trading decisions.

If you want to learn more about technical trading, you can also review some basic concepts such as Support and Resistance, Candlestick Charts, and Trends.

Every trader is unique and must refine his or her strategy over time. Some traders have very complex strategies, while others prefer to keep it simple. As you execute your trades and test more strategies for yourself, you will find a unique style that suits you. These are some basic ones to help you get started, but remember that the most important thing is for you to simply START. You can read all the articles you want, but unless you try it yourself, nothing will happen.

Good luck on your trades and remember, we’re always here to help!

What are the best stock trading tips you’ve received? Share them in the comments below and let’s move forward together!

Subscribe to InvestaDaily for more articles like these, or sign up for Investagrams to access special features to help you reach your first million.